Property Tax Yellowstone

It is important to stay up to date with your property taxes. In Yellowstone County, residents can easily find out and pay their property taxes online through the county’s website. The process is simple and secure, allowing you to check your records and pay your taxes quickly and conveniently.

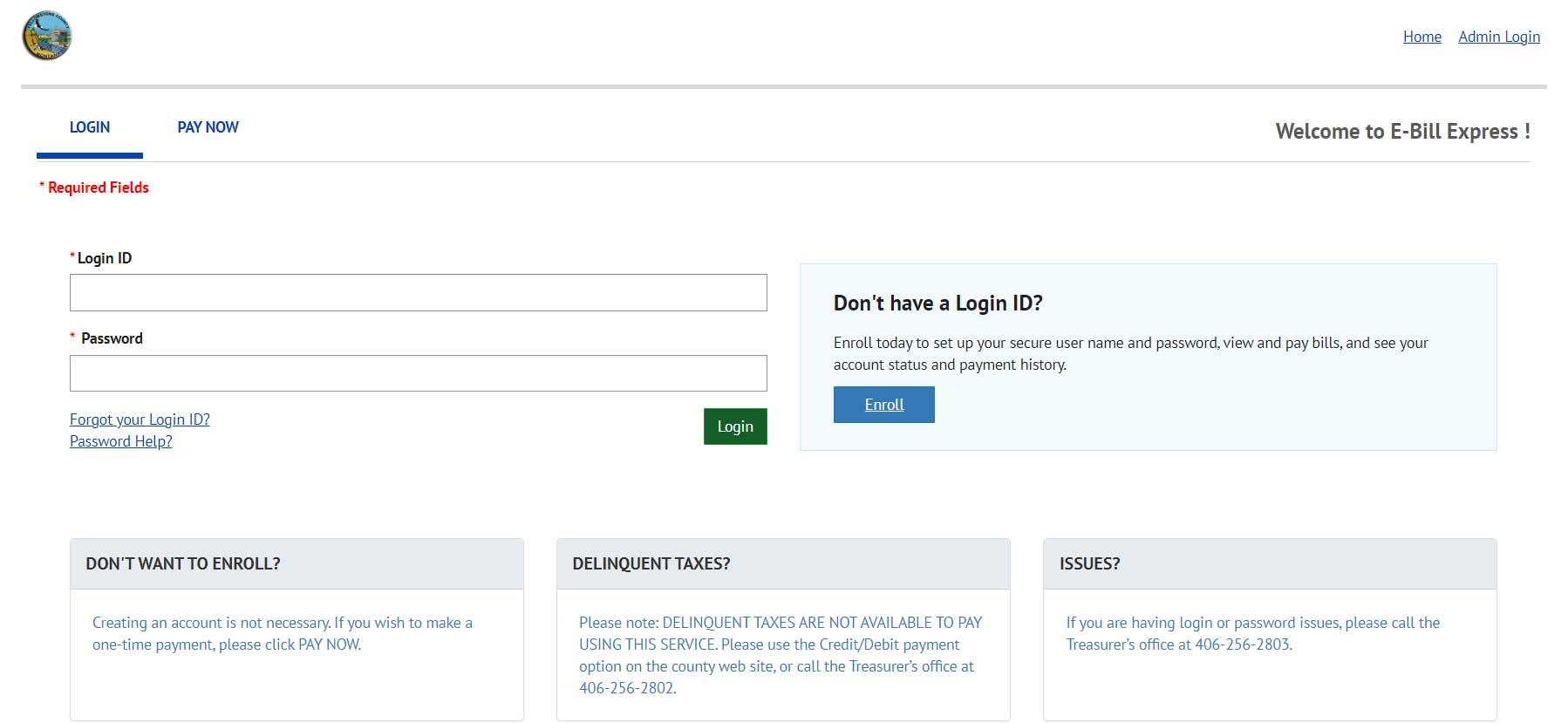

The website offers an easy-to-use search tool that allows you to look up your tax record by address or property ID. Once you have located your record, you can view your tax information and pay your taxes online. You can also review the county’s property tax rates and make payments with a major credit card. You can also set up a payment plan if you need to spread out your payments over time.

Paying Property Taxes in Montana: A Step-by-Step Guide

Paying Property Taxes in Montana: A Step-by-Step Guide

Montana is one of the few states in the US that does not have a unified property tax system. Each county in Montana has its own rules and regulations for assessing and collecting property taxes. This guide will provide a step-by-step process for paying property taxes in Montana.

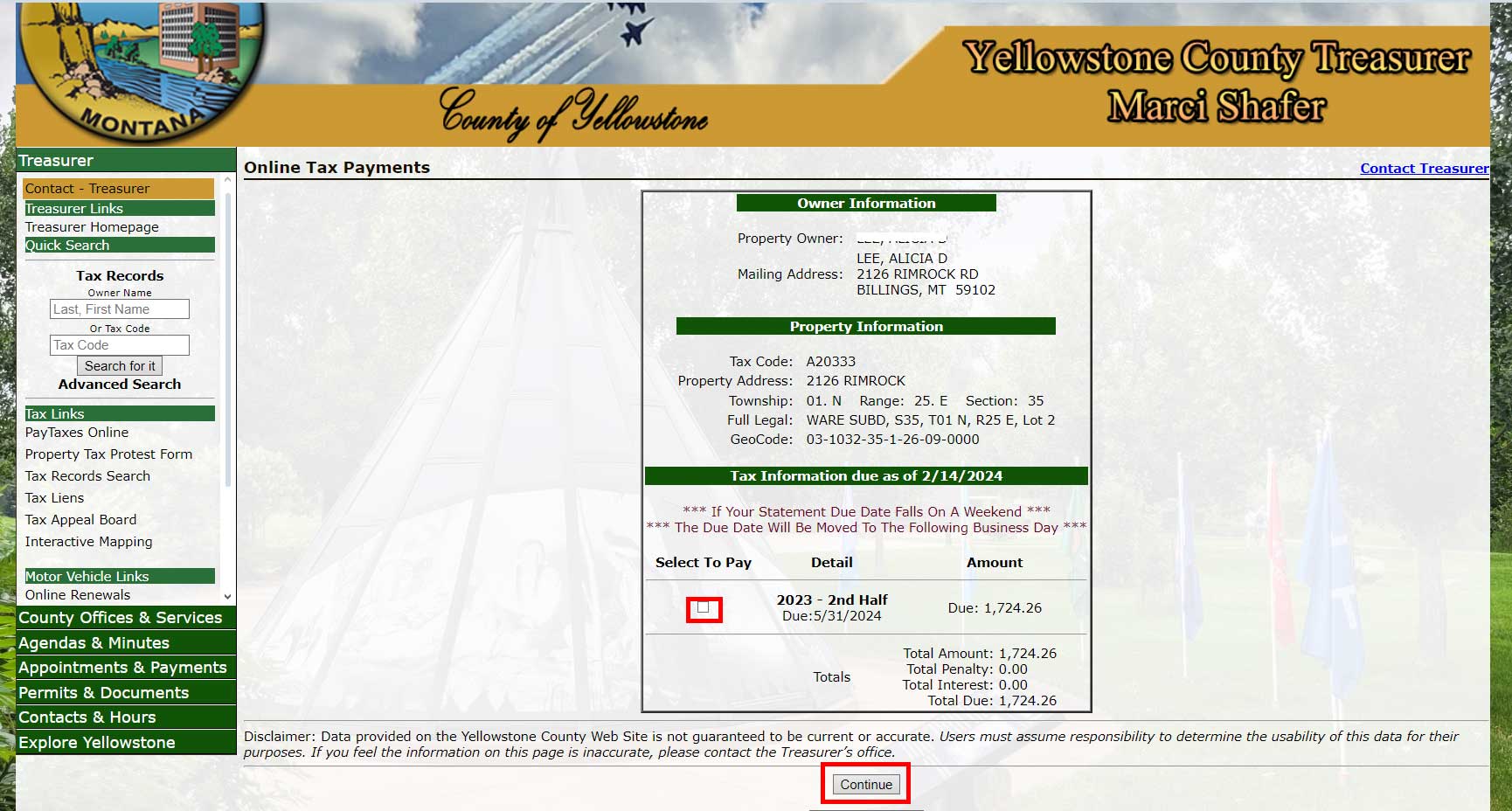

1. Lookup your property tax information: Before you can pay your property taxes, you need to know how much you owe. You can do this by visiting your county assessor’s office or searching online for records. You can also search by map or by property address.

2. Search for your property tax rate: Each county in Montana has its own property tax rate. This rate is determined by the county assessor each year and is based on the value of your property. You can find your property tax rate online or by contacting your county assessor.

3. Calculate your property taxes: Once you have your property tax rate, you can use it to calculate your property taxes. To do this, simply multiply the rate by the assessed value of your property. You can also contact your county assessor for help calculating your taxes.

4. Query your property tax bills: Once you have calculated your taxes, you will need to query your county assessor for any unpaid bills. Most counties in Montana allow you to query online or by mail. You can also call your county assessor to get more information on your bills.

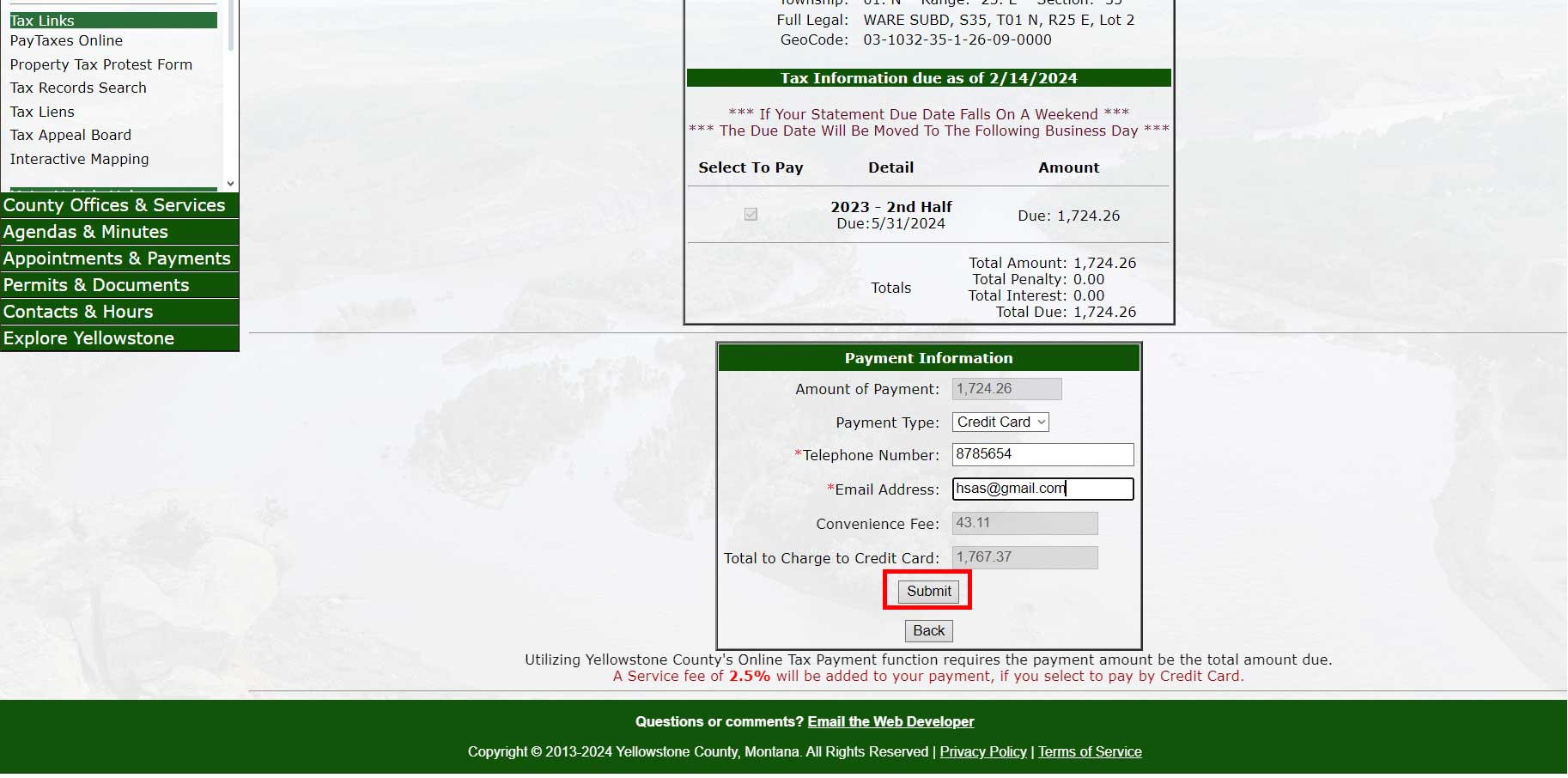

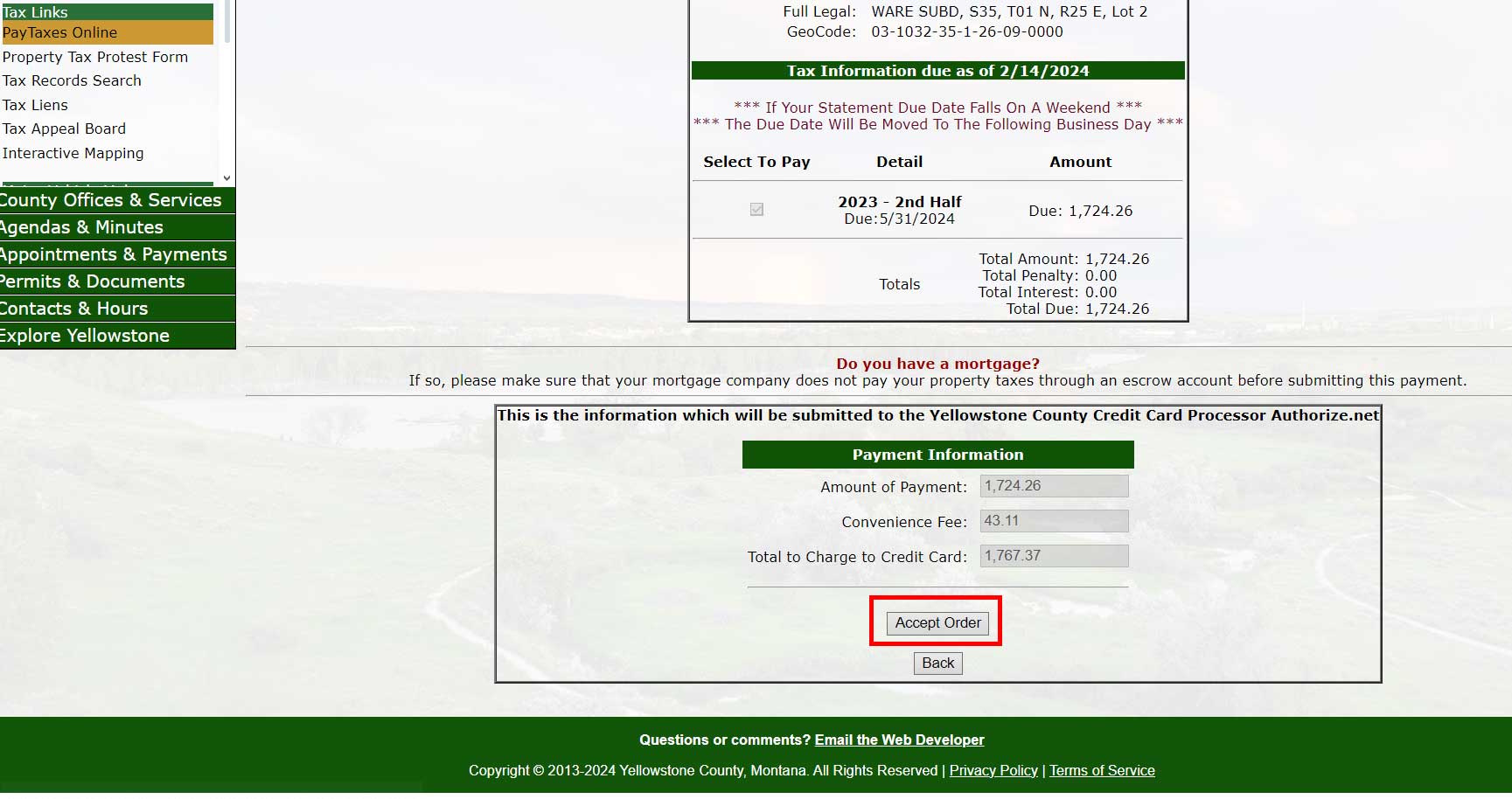

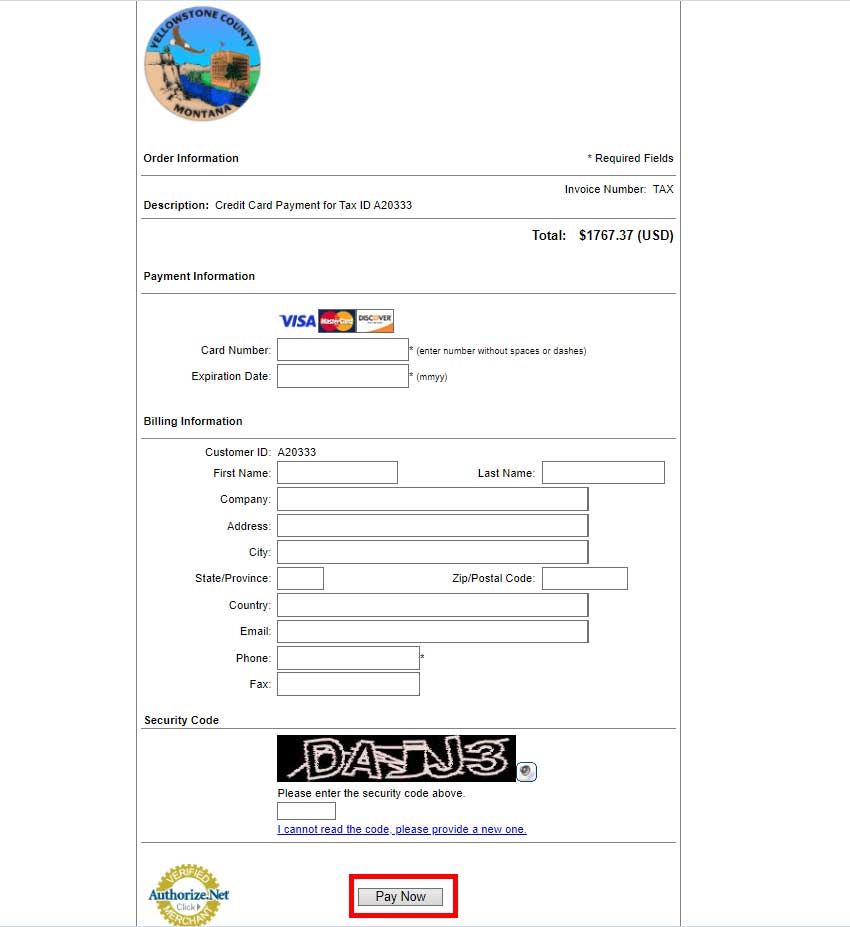

5. Pay your property taxes: Once you have determined how much you owe, you can pay your taxes online, by mail, or in person. Most counties in Montana accept major credit cards and electronic checks. You can also pay with cash if you are paying in person.

6. Receive your receipt: Once you have paid your property taxes, you will receive a receipt. This is important for filing your taxes and proving that you paid your taxes on time. Make sure to keep your receipt in a safe place.

Paying property taxes in Montana can seem intimidating, but it doesn’t have to be. By following these steps, you can easily pay your property taxes and keep your records up-to-date. If you have any questions or need assistance, you can always contact your county assessor for help.

Property Tax Relief for Seniors in Montana

Property Tax Relief for Seniors in Montana: What You Need to Know

Montana offers property tax relief for seniors who own their own homes. This relief helps seniors to lower their tax bill, allowing them to better manage their finances and stay in their homes. Here’s what you need to know about property tax relief for seniors in Montana.

What Types of Property Are Eligible?

Property tax relief is available for seniors who own their home in Montana. This includes single-family homes, condos, and townhouses. In order to qualify for relief, seniors must be at least 65 years old and must be the sole owner of the property.

How Much Can You Save?

The amount of property tax relief available varies depending on the county in which you live. In Yellowstone County, for example, seniors can receive up to $3,000 in property tax relief. This relief is applied to the tax bill and can help seniors significantly reduce their tax burden.

How Do You Apply?

Seniors who want to apply for property tax relief in Montana must first lookup their county assessor’s office. Each county assessor has specific rules and procedures for applying for relief. Generally, you will need to fill out an application and provide proof of your age and income. You may also need to provide evidence that you are the sole owner of the property.

How Are Tax Rates Determined?

Tax rates in Montana are determined by the county assessor. The assessor uses a variety of factors, including the value of the property, the type of property, and the location of the property. The assessor also takes into account the current market rate and any applicable state or local laws.

Where Can I Find Property Tax Records?

Property tax records are public and can be found in county courthouses or online. County courthouses typically have records dating back several years, while online records are often available for searching and viewing. Property tax records typically include the owner’s name, the address of the property, and the amount of taxes due.

How Do I Pay My Property Tax Bill?

Property tax bills are typically mailed out by the county assessor at the beginning of the year. You can pay your bill online, by mail, or in person. Some counties may also offer payment plans or other options for payments. Once your bill is paid, you will receive a statement or receipt.

How Can I Find Out the Value of My Property?

The county assessor is responsible for determining the value of property in the county. The assessor must use a variety of factors, including the size of the property, the age of the property, and the map location of the property. You can contact your local assessor to get an appraiser to assess the value of your property.

When Are Property Taxes Due?

Property taxes in Montana are typically due on April 15th. However, the due date may vary depending on the county. You can contact your local assessor or query the county website to find out the exact due date of your taxes.

Property tax relief for seniors in Montana is an important way to help seniors manage their finances and stay in their homes. With the right information, seniors can take advantage of this relief and save money on their tax bills.

What is the Property Tax Rate in Montana?

What is the Property Tax Rate in Montana? Montana has a progressive property tax system, meaning the rate of property tax can vary depending on the county or municipality in which the property is located. The exact rate of property tax is determined by the county assessor’s office and can be viewed online or by visiting the local assessor office. Property tax rates in Montana are generally between 0.8% and 1.2%.

Property owners in Montana can lookup their property tax rate by searching the county assessor’s records, which are typically available online. Also Property owners can also use mapping tools to find their county assessor’s office and get more detailed information about their property tax rate. Additionally, property owners can contact the county assessor’s office for help in understanding their property tax rate and any related questions.

Montana property owners are responsible for paying their property taxes on time. The due date for property taxes is typically set by the county assessor, and property owners can find this information by requesting a statement or receipt from the assessor’s office. Property owners can also view the due date online or through their county assessor’s website. It is important to pay property taxes on time to avoid penalties and other fees.

To find out the exact property tax rate in Montana, property owners should contact their local county assessor or use the online query tools available on the Montana state website. Property owners can also use mapping tools to locate their assessor’s office and get more detailed information about their property tax rate. It is important to pay property taxes on time to avoid penalties and other fees.